Official mCash mobile app is available for download only in Google Play Store, Huawei app gallery and Apple Store.

SLT-Mobitel Mobile Reloads & Bill Payments

SLT-Mobitel Home

Hutch 072 / 078

Airtel

Ceylon Electricity Board

Lanka Electricity Company

Water Supply Board

Kandy Municipal Council

Nuwera Eliya Municipal Council

Ask Cable Vision

AIA Insurance

Allianz Insurance

Amana Takaful

Softlogic Insurance Life

Ceylinco Life

Ceylinco General Insurance

HNB Assurance

Janashakthi Insurance

Sri Lanka Insurance Corporation - Life

Sri Lanka Insurance Corporation - General

Union Assurance

MBSL Insurance

HNB General Insurance

Fairfirst Insurance

LOLC Life Insurance

Orient Insurance

Sanasa Life Insurance

Continental Insurance - General

COOP Life Insurance

Peoples Insurance

Citizen Business Development Finance

LOLC Finance (Micro Loan Repayment)

Merchant Bank of Sri Lanka and Finance

Arpico Finance

Associated Motor Finance

HNB Finance - Loan & Lease

Mercantile Investment and Finance

Singer Finance

People's Leasing and Finance

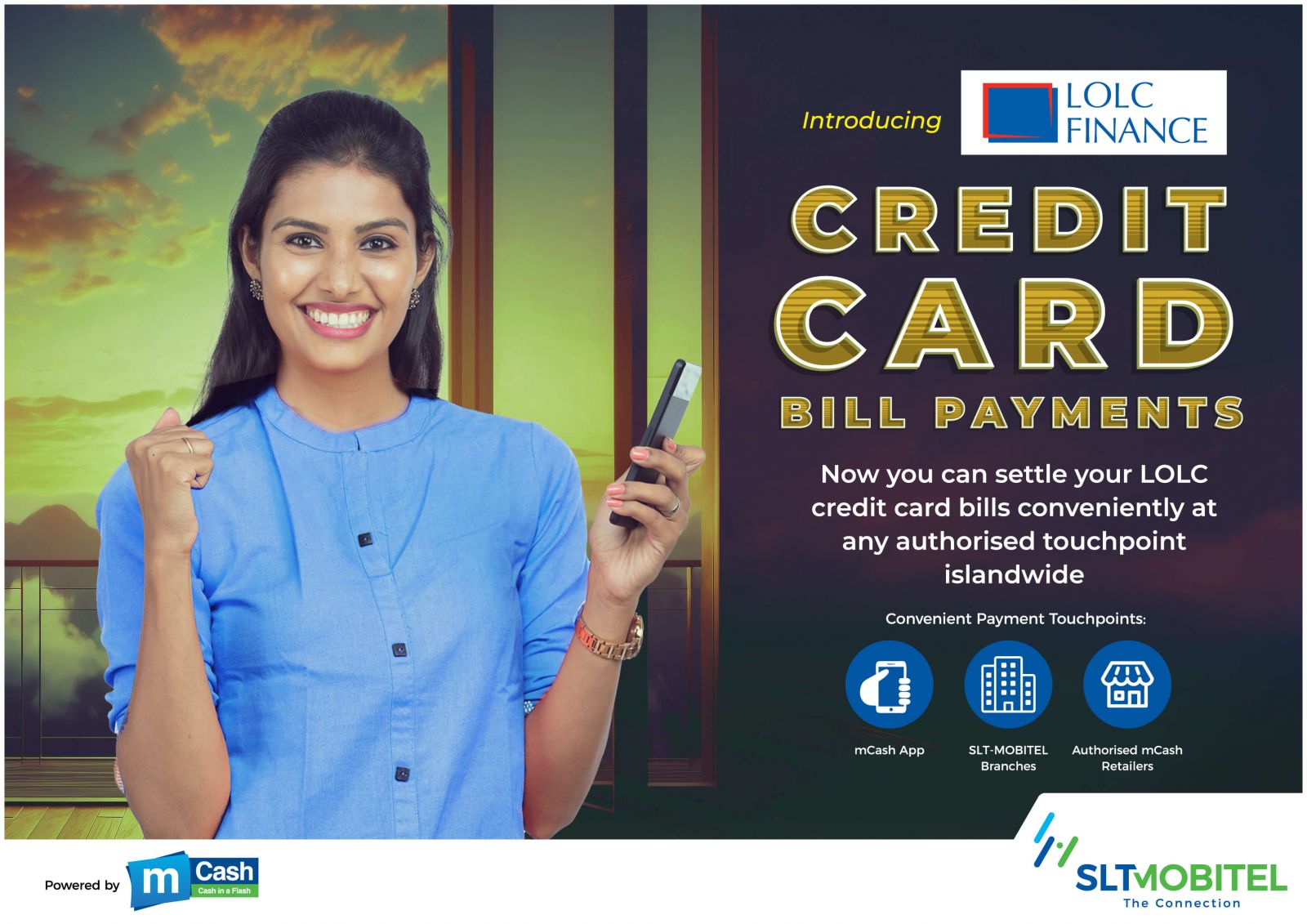

LOLC Finance - Credit Card Payments and Savings Deposits

Hatton National Bank - Savings Deposits

Union Bank - Loan Repayments, Credit Card Payments and Savings Deposits

.jpg)

Customers can now conveniently pay utility bills,

local government bills, and Takeful insurance premiums and top-up their mCash accounts at any Amana Bank branch around the island.

Step 1: Simply dial #111# and follow the instructions that appear on your screen

Step 2: After you register successfully, you will receive a SMS notification

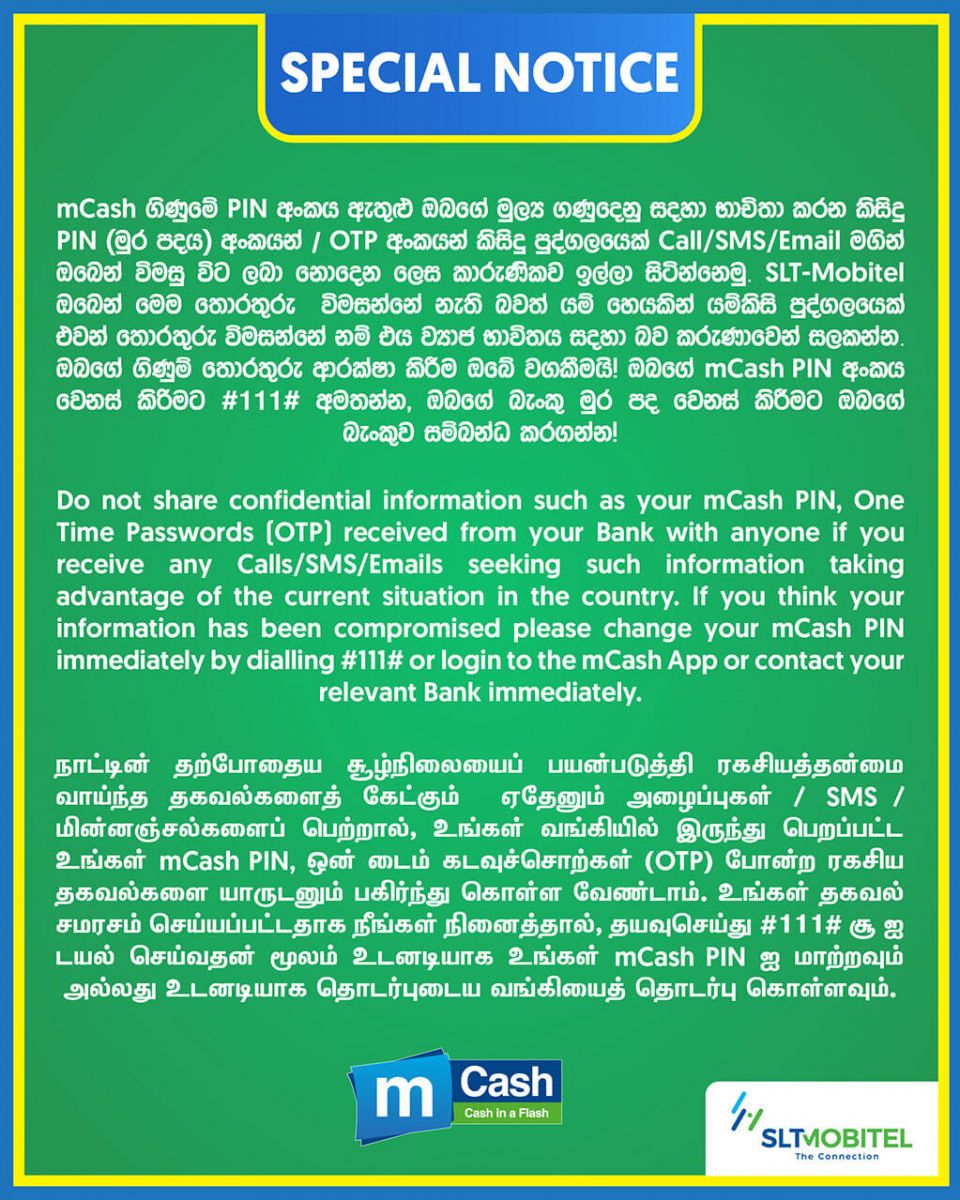

Please ensure that your PIN is kept confidential at all times.

You could register for a Basic mCash Account by dialing #111# and upon registration you’ll be entitled to an account limit of Rs. 20,000.

If you wish to, you may upgrade your account to an Enhanced Account with an account limit of Rs. 150,000.

Please visit your nearest Mobitel Service Point or download the application form and submit it to the nearest Mobitel Service Point to upgrade to an Enhanced Account.

mCash Collaborates with Union Bank to offer Agency Banking Services to their customers via mCash Platform. This service will enable the customers of Union Bank to make Deposits, Loan and Credit Card Repayments via mCash Channels conveniently.

Any Union Bank customer can make deposits and payments to Union Bank of Colombo PLC.

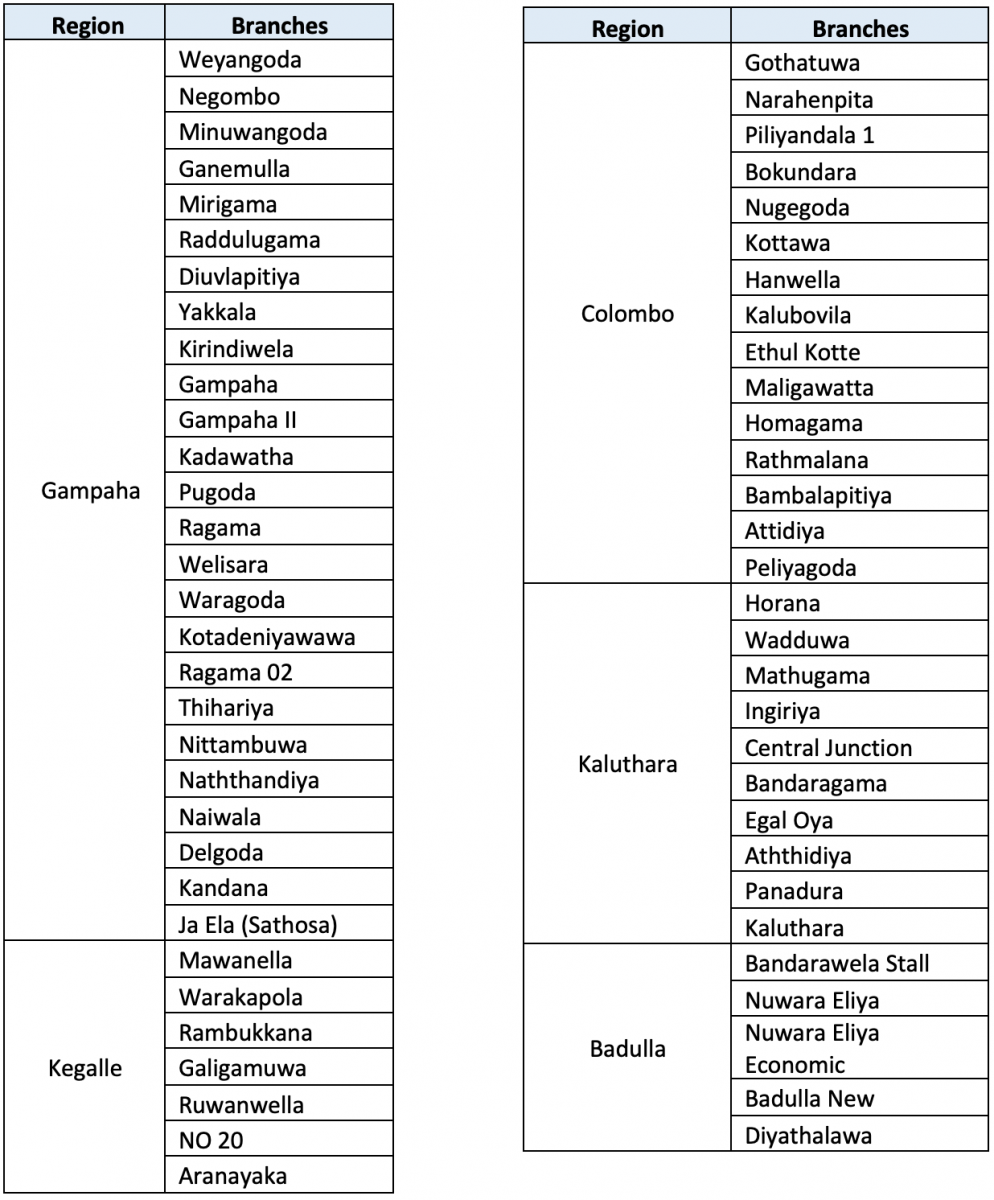

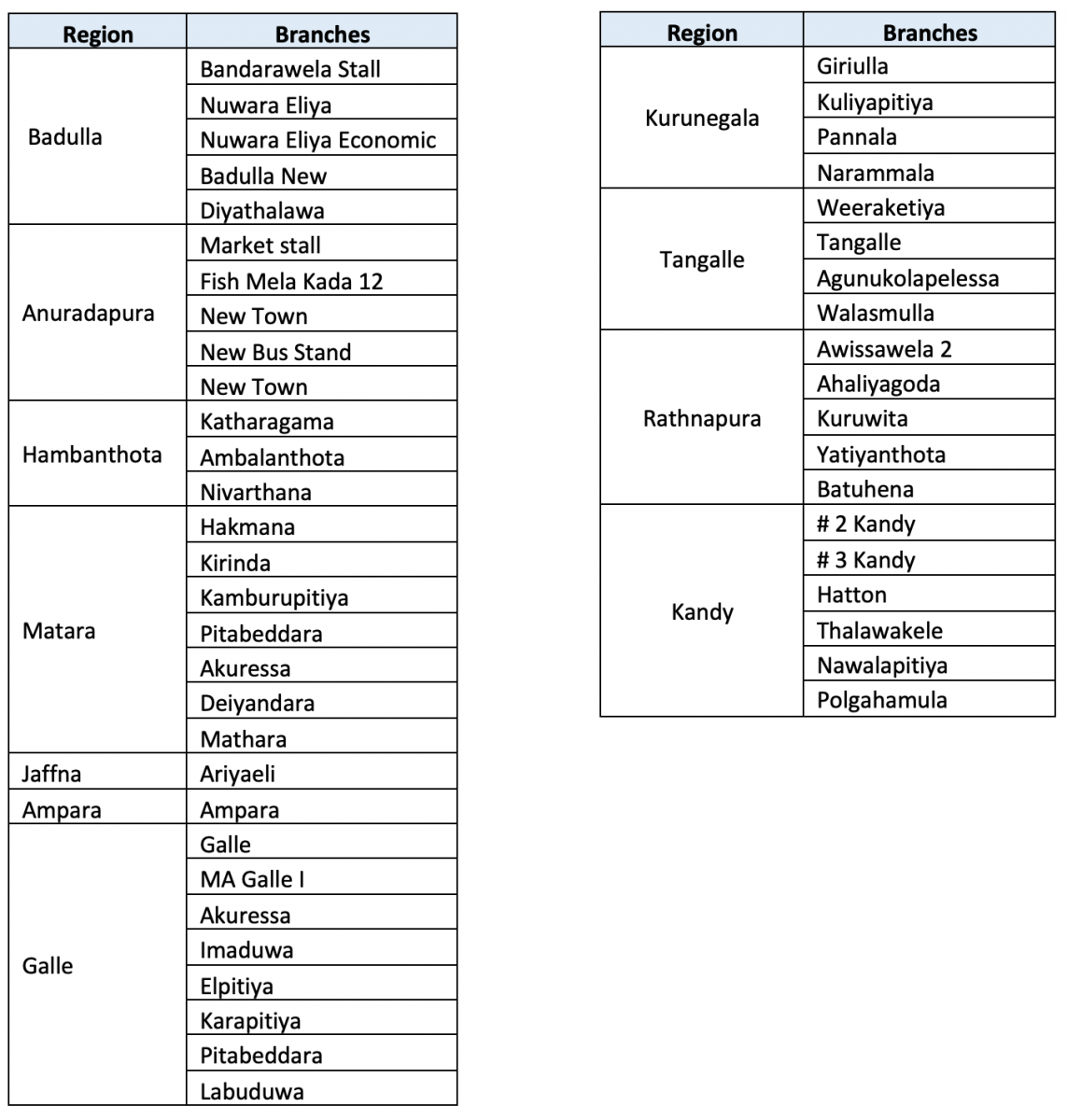

Customers can make deposits or loan/credit card payments to Union Bank by visiting any of the SLT-Mobitel branches island wide.

Anyone can make their payments to Union Bank using the following steps;

A confirmation SMS will be sent to the given contact mobile number upon successful payment

Union Bank customers are required to provide the 12 digit Credit Card account number linked to their respective UB Credit card to make their payments via mCash. Payments cannot be accepted if the 16 Digit Credit Card number is provided. Hence, it is mandatory for the customer to provide the 12-digit account number.

Below are the maximum amounts that could be paid via mCash per day:

All Union Bank deposits and payments made via mCash are updated real-time.

Deposits and Loan/Credit Card repayments of Union Bank via mCash is free of cost.

After each deposit, loan/credit card payment made via mCash, a Confirmation SMS will be sent confirming the transaction to the provided Mobile number.

Similarly, an SMS will be sent by Union Bank to the respective account holder’s mobile number maintained at their system.

Customers may contact Union Bank for any enquiries via 011 5 800 800.

|

Name of Agent |

Address |

Contact Number |

|

Mobitel Branch Network |

Mobitel Flagship Store, No. 108, W.A.D. Ramanayake Mw, Colombo 02. |

071 275 5777 |

|

Airport Arrival Branch., Shop No.HH1,Arrival Public Concourse,BIA,Katunayaka. |

0112 265 555 |

|

|

Airport Departure Branch, Shop No.19D,Departure Concourse,BIA,Katunayaka. |

0112 265 555 |

|

|

Anuradhapura Branch, No.36,Maithreepala Senanayake Mw,Anurahdpura. |

071 275 5777 |

|

|

Jaffna Branch, No. 1,Ruban Complex, Stanly Road, Jaffna. |

071 275 5777 |

|

|

Kandy Flagship Store, Kandy City Centre,No. 5, Dalada Veediya, Kandy. |

071 275 5777 |

|

|

Kurunegala Branch, No. 183C, Colombo Rd, Kurunegala. |

071 275 5777 |

|

|

Matara Branch, No. 15, LGJ Building, Beach Road, Matara. |

071 275 5777 |

|

|

Ratnapura Branch, No 227, Main Street, Ratnapura. |

071 275 5777 |

|

|

WTC Branch, Level 3, East Block, World Trade Centre, Echelon Square, Colombo 01. |

071 275 5777 |

|

|

Batticloa Branch, No.39/4,Central Rd,Batticaloa |

071 275 5777 |

|

|

Liberty Plaza Branch , 1st Floor, Liberty plaza,Colombo 03. |

071 275 5777 |

|

|

M Ticketing Centre - Fort, Sri Lanka Railway Station, Fort. |

071 275 5777 |

|

|

M Ticketing Centre - Jaffna, Sri Lanka Railway Station, Jaffna |

071 275 5777 |

|

|

Immigration & Emigration Department, Mobitel Office,"Suhurupaya", Sri Subuthipura Road,Battaramulla. |

071 275 5777 |

|

|

Department of Pension, Maligawatta,Colombo 10 |

071 275 5777 |

|

|

IOT Branch, No.409,R.A.De Mel Mw,Colombo 04. |

071 275 5777 |

|

|

SLT & Mobitel Mini Branch, B.M.I.C.H,Bauddhaloka Mw,Colombo 07. |

071 275 5777 |

|

|

Mobitel Mini Branch, One Galle Face |

071 275 5777 |

|

|

Mobitel Mini BranchRotunda Tower |

071 275 5777 |

|

|

Mobitel Mini Branch,Singer Mega, Gampaha, 103, Colombo Road, Gampaha |

071 275 5777 |

|

|

Mobitel Mini Branch,Singer Mega, Kandy, 213, Peradeniya Road, Kandy |

071 275 5777 |

|

|

Mobitel Mini Branch,Singer Mega, Mount Lavinia, 326, Galle Road, Mount Lavinia |

071 275 5777 |

|

|

Mobitel Mini Branch,Singer Mega, Negombo, 220/A , Colombo Road, Negombo |

071 275 5777 |

|

|

Mobitel Mini Branch, Singer Mega, Wattala, 811, Negombo Road, Wattala |

071 275 5777 |

|

|

Mobitel Mini Branch, Singer Mega, Kiribathgoda, 93, Kandy Road, Dalugama, Kelaniya |

071 275 5777 |

|

|

Mobitel Mini Branch, Singer Mega, Malabe, 16/6A, New Kandy Rd,Thalahena |

071 275 5777 |

|

|

Mobitel Mini Branch, Singer Mega,Kalutara, No.28,Galle Rd,Kalutara North |

071 275 5777 |

|

|

Mobitel Mini Branch, Singer Mega,Boralesgamuwa, No.202,Werahera Rd,Boralesgamuwa |

071 275 5777 |

|

|

Mobitel Mini Branch, Singer Mega,Panadura, No.585 & 587,Galle Rd,Panadura |

071 275 5777 |

|

|

Mobitel Mini Branch,Singer Mega,Kottawa, No.94C,Athurugiriya Rd,Kottawa. |

071 275 5777 |

|

|

Mobitel Mini Branch,Singer Mega,Kaduwela, Kaduwela Town |

071 275 5777 |

|

|

Mobitel Mini Branch,Singer Mega,Kurunegala, Kurunegala Town |

071 275 5777 |

|

|

Mobitel Mini Branch,Singer Mega,Delkada, Nugegoda |

071 275 5777 |

|

|

Mobitel Mini Branch,Singer Mega,Negombo road, Paliyagoda |

071 275 5777 |

|

|

Mobitel Mini Branch,Singer Mega,Colombo road, Katubedda |

071 275 5777 |

|

|

Sri Lanka Telecom Branch Network |

Sri Lanka Telecom Teleshop , Galle Road,Ambalangoda. |

0912 253 831 |

|

Regional Telecom Office, Sri Lanka Telecom, Ampara. |

071 455 2128 |

|

|

Regional Telecom Office, Sri Lanka Telecom, King's Street,Badulla. |

0552 222 231 |

|

|

Sri Lanka Telecom Teleshop , Mangala Rd, Beruwala. |

0342 222 231 |

|

|

SLT Teleshop, Punchi Borella. |

071 275 5777 |

|

|

Regional Telecom Office, Sri Lanka Telecom, Bandarawela. |

0572 222 231 |

|

|

Regional Telecom Office,Puttlam Rd,Chilaw. |

0322 222 231 |

|

|

Sri Lanka Telecom, Lower Chathum Street, Colombo 01. |

0112 393 322 |

|

|

Regional Telecom Office, Sri Lanka Telecom, Wakwella Rd, Galle. |

0912 222 231 |

|

|

Sri Lanka Telecom Teleshop , No.1, Nawalapitiya Road, Gampola. |

0812 352 231 |

|

|

Regional Telecom Office, Sri Lanka Telecom, Beach Road, Hambanthota. |

0472 220 231 |

|

|

Sri Lanka Telecom Teleshop , Hatton. |

0512 222 231 |

|

|

Regional Telecom Office, Sri Lanka Telecom, Havelock Town, Colombo 05. |

0112 502 230 |

|

|

SLT Teleshop,Main Street,Kalmune. |

0672224992 |

|

|

Regional Telecom Office, Sri Lanka Telecom, Kalutara. |

0342 222 231 |

|

|

Regional Telecom Office, Kalugalla Mw, Kegalle. |

0352 222 231 |

|

|

Regional Telecom Office, 155 th Mile Post, A9 Road, Kilinochchi. |

0212 285 231 |

|

|

SLT Teleshop,Horana. |

071 275 5777 |

|

|

SLT Teleshop,Dambulla. |

071 275 5777 |

|

|

Sri Lanka Telecom Telesho, Madampe Rd, Kuliyapitiya. |

0372 283 555 |

|

|

Regional Telecom Office, Sri Lanka Telecom, Beach Road, Mannar. |

0232 222 231 |

|

|

Regional Telecom Office, Sri Lanka Telecom, Mathale. |

0662 222 231 |

|

|

Sri Lanka Telecom Teleshop,P.W.D Road,Mullaitheivu Town,Mullaitheivu. |

0112 502 230 |

|

|

Regional Telecom Office, Sri Lanka Telecom, St. Joseph's Street, Negombo. |

0312 231 570 |

|

|

Sri Lanka Telecom Teleshop ,No 01 B, Kandy Rd, Nittambuwa. |

||

|

Regional Telecom Office, Sri Lanka Telecom, Highlevel Rd, Nugegoda. |

||

|

Regional Telecom Office, Sri Lanka Telecom, Nuwara Eliya. |

0522222231 |

|

|

Regional Telecom Office, Sri Lanka Telecom, Galle Road, Panadura. |

||

|

Sri Lanka Telecom Office ,Galaha Rd,Peradeniya |

||

|

No.60,Wevakumbura Road,Saranapala Mw, Piliyandala. |

0112606141 |

|

|

Regional Telecom Office, Sri Lanka Telecom, Batticaloa Rd, Polonnaruwa. |

||

|

Sri Lanka Teleceom Office,Kurunegala Rd,Puttlam |

||

|

Regional Telecom Office, Sri Lanka Telecom, Galle Road, Rathmalana. |

||

|

Regional Telecom Office, Sri Lanka Telecom, Inharbour Road, Trincomalee. |

||

|

Regional Telecom Office, Sri Lanka Telecom, Sivapiragasa School Rd, Vauniya. |

||

|

Sri Lanka Telecom Teleshop ,No 273, Colombo Rd, Wennappuwa. |

031 2250995 |

|

|

SLT Teleshop, No 63 1/4 & 63 1/5 Rambukkana Rd Mawanella |

035 2246240 |

|

|

SLT Teleshop, Homagama |

071 275 5777 |

|

|

SLT Teleshop, Kolonnawa |

071 275 5777 |

|

|

SLT Teleshop, Monaragala |

071 275 5777 |

|

|

SLT Teleshop, Kandy |

071 275 5777 |

|

|

SLT Teleshop, Avissawella |

071 275 5777 |

|

|

SLT Teleshop, Kamburupitiya |

071 275 5777 |

|

|

SLT Teleshop, Kirindiwela, Gampaha |

071 275 5777 |

|

|

SLT Teleshop, Bandaragama |

071 275 5777 |

|

|

SLT Teleshop, Boralesgamuwa |

071 275 5777 |

|

|

SLT Teleshop, Maharagama |

071 275 5777 |

|

|

SLT Teleshop, Mattakkuliya |

071 275 5777 |

|

|

SLT Teleshop, Baddegama |

071 275 5777 |

|

|

SLT Teleshop, Balangoda |

071 275 5777 |

|

|

SLT Teleshop, Battaramulla |

071 275 5777 |

|

|

SLT Teleshop, Ambilipitiya |

071 275 5777 |

Customers of Amana General Insurance can now pay their premiums conveniently at any of the customer touchpoints powered by mCash.

Specialty is that the customer does not necessarily have to be a SLT-Mobitel or mCash customer to make payments though these touch points. A customer of Amana General Insurance attached to any mobile network is eligible to pay through selected touchpoints.

Amana General Insurance Premium payments

Customers may use payment methods accepted by the touchpoints (i.e. Cash, Card payments, mCash, LankaQR payments).

Customers may contact 7111 for all inquiries.

mCash Collaborates with LOLC Finance to offer Credit Card payment services to their customers via mCash Platform. This service will enable the customers of LOLC Finance to make Credit Card payments via mCash channels conveniently.

Any LOLC Finance Credit Card customer can make Payments via mCash.

Anyone can make their payments to LOLC Finance Credit Cards using the following steps.

A confirmation SMS will be sent to the given contact mobile number upon successful payment.

No limitations for the amount and no of payments per day.

All LOLC Finance Credit Card transactions are made via mCash are updated real-time.

Transactions of LOLC Finance Credit card payments via mCash is free of charge.

After the payment is made via mCash, a confirmation SMS will be sent confirming the transaction to the provided Mobile number.

Similarly, an SMS will be sent by LOLC Finance to the respective account holder’s Credit Card registered mobile number maintained at their system.

Customers may contact LOLC Finance for any general enquiries via +94 11 5718888, for Product SAVI via +94 11 5713333 and for Product Swairee via +94 11 7 844 744.

LANKAQR is a standardized Quick Response code introduced by the Central Bank of Sri Lanka to enable c onvenient and low cost contactless payment.

By scanning the QR code displayed, Customers can Topup their mCash wallet via LANKAQR.

Step 1: Scan the displayed QR code using any LANKAQR certified mobile payment App

Step 2: Enter mCash account Number in the ‘Reference Label’ section

Step 3: Enter amount

Step 4: Confirm Transaction

*Customer cannot use their own mCash account to Topup their mCash account via LANKAQR.

LANKAQR is a standardized Quick Response code introduced by the Central Bank of Sri Lanka to enable convenient and low cost contactless payment.

By scanning the QR code displayed here, customers can pay their SLT-Mobitel postpaid Mobile bill.

Step 1: Scan the QR code displayed here using any LANKAQR certified mobile payment App

Step 2: Enter the Mobile Number in the ‘Reference Label’ section

Step 3: Enter Payment Amount

Step 4: Confirm Payment

To celebrate Sri Lanka’s 77th Independence Day, mCash is offering customers the opportunity to pay their bills Free-of-Charge using the mCash Customer App and USSD #111# on 4th February 2025.

The offer is valid only on 4th February 2025, from 00:00 am to 11:59 pm.

You can pay your bills using the mCash Customer App / USSD #111# on 4th February 2025 without incurring any service charges.

Yes, you can make multiple-bill payments during the offer period.

For any assistance or inquiries, you can call mCash customer care on 7111.

Customers are expected to use the promotion in good faith and if Mobitel (Pvt) Ltd or the partners identify that a Customer is misusing the promotion or if he/she is not adhering according to Fair User Policy, then the customer shall be suspended from enjoying the service as deemed necessary. Mobitel (Pvt) Ltd and its partners reserve the right to conclude or change this offer at any point of time without prior notice.

| mCash Transaction Charges | |

| Customer wallet | |

| Charging Type | Charges (Rs.) |

| Wallet Registration Fee | Free |

| Transaction Type | Transaction Charges (Rs.) |

| Balance Check | Free |

| Cash Topup | Free |

| Cash Withdrawl (From Retailers) | For Every 1000 - Rs.20 |

| Change Pin | Free |

| Change Preferred Language | Free |

| Detailed Printed Statement | Rs. 200 at Mobitel Branches |

| Institutional Payments | Free |

| mCash App Download | Free |

| Mini Statement | Free |

| Payments of Good | Free |

| P2P Fund trasfer (mCash to mCash) | Free |

| CEB Bill Payments only via Customer wallet | |

| Slabs | Transaction Charges (Rs.) |

| Less than Rs. 200 | Rs. 10 |

| Above Rs. 200 upto Rs. 1000 | Rs. 15 |

| Above Rs. 1000 upto Rs. 10,000 | Rs. 20 |

| Above Rs. 10,000 upto Rs. 30,000 | Rs. 25 |

| Above Rs. 30,000 upto Rs. 50,000 | Rs. 30 |

| Above Rs. 50,000 | Rs. 40 |

| CEB Bill Payments via mCash Retailer | |

| Slabs | Transaction Charges (Rs.) |

| Less than Rs. 5,000 | Rs. 30 |

| More than Rs.5,000 | Rs. 40 |

| LECO, Water, Kandy, N'Eliya MC & Ask Cable Bill Payments via mCash | |

| Slabs | Transaction Charges (Rs.) |

| Less than Rs. 5,000 | Rs. 30 |

| More than Rs.5,000 | Rs. 40 |

| Other Bill Payments via mCash | |

| Slabs | Transaction Charges (Rs.) |

| Amana Takaful PLC | Rs. 20 |

| Softlogic Life PLC | Rs. 20 |

| Agency Banking Payments (HNB/UB/LOLC) | Free |

| Institutional payments | Free |

| Telco Payments (Mobitel/ Airtel/ Hutch/ SLT) | Free |

| Cash Withdrawal Charges- Commercial Bank ATM | |

| Slabs | Transaction Charges (Rs.) |

| For Every Rs.1000 | Rs. 20 |

.jpg)

mCash collaborates with PickMe to offer collection management services to their drivers/riders via mCash platform. This service will enable the drivers/riders of PickMe to make their driver collection payments via mCash channels conveniently.

Any driver/rider registered with PickMe can conveniently conduct transactions via mCash channels

Anyone driver/rider registered with PickMe can make their payments to PickMe using the following steps.

A confirmation SMS will be sent to the given contact mobile number upon successful payment.

| Segment | Amount (LKR) | Condition |

|---|---|---|

| PickMe | Rs. 250,000 | Per transaction |

All PickMe transactions made via mCash will be updated real-time

Payments conducted to PickMe via mCash is free of cost.

After the payments are made via mCash enabled platforms, a confirmation SMS will be sent to the driver/rider confirming the transaction to the provided mobile number.

Similarly, an SMS will be sent by PickMe to the respective driver’s mobile number maintained at their system.

Mobitel: PickMe drivers/riders can dial 7111 if they wish to contact for inquiries or to lodge complaints

PickMe: PickMe drivers/riders can dial 0114 507507 if they wish to contact or raise concerns via Inapp if they wish to lodge complaints"

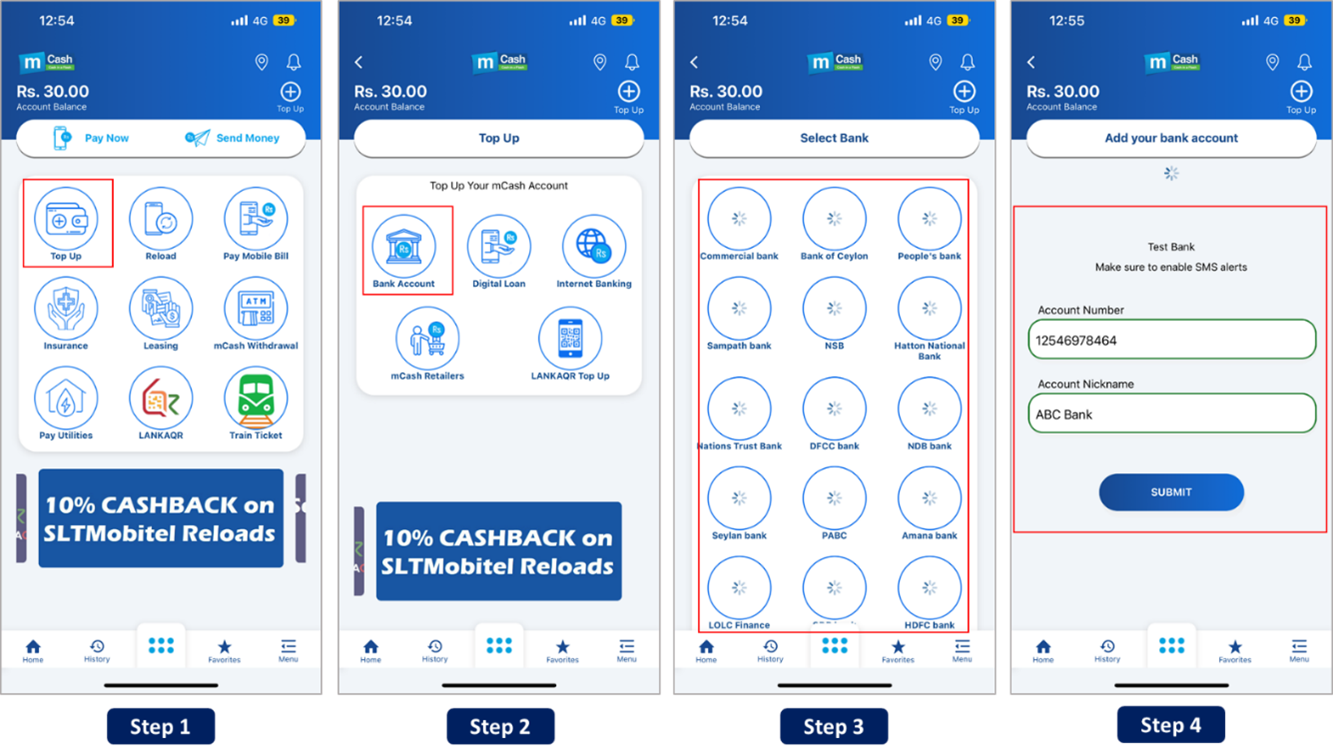

SLT-Mobitel, the National Mobile Service Provider, has partnered with LankaPay Brainchild, JustPay©, a secure, real-time payment service, to enable SLT-Mobitel mCash customers to top up their wallet directly from their preferred Bank Account.

mCash App customers can Top Up their wallets from their preferred bank account real time up to Rs 50,000.

Yes, Existing customers can use this service by successfully adding their bank account in the mCash App.

Yes. You need successfully register for the mCash service by downloading the mCash app from the Android Play Store, Apple App Store or Huawei Gallery in order to use this service.

Standard mCash wallet limits applicable***

1. Download mCash App on your Smart Phone

2. Enter mobile number

3. Select your preferred Language

4. Enter NIC Number

5. Create a PIN

6. Consent to Terms & Conditions

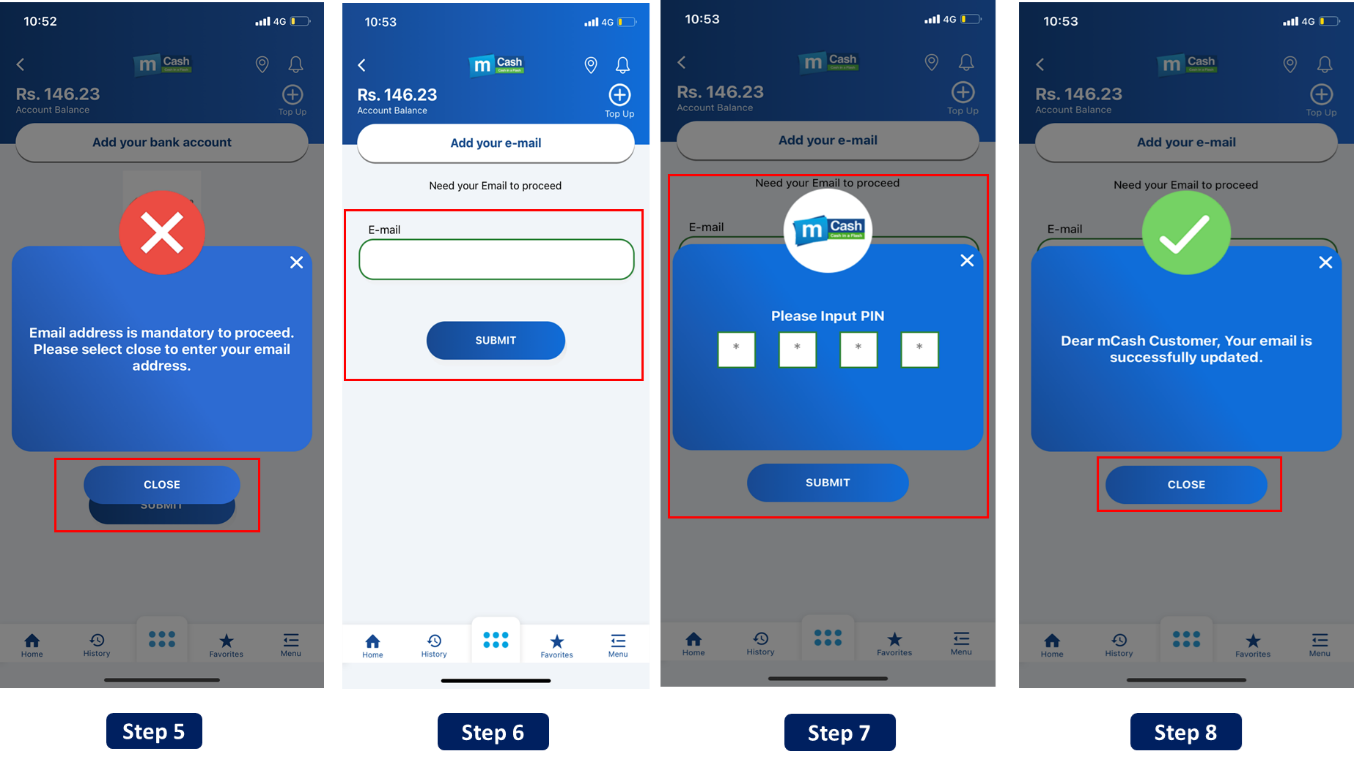

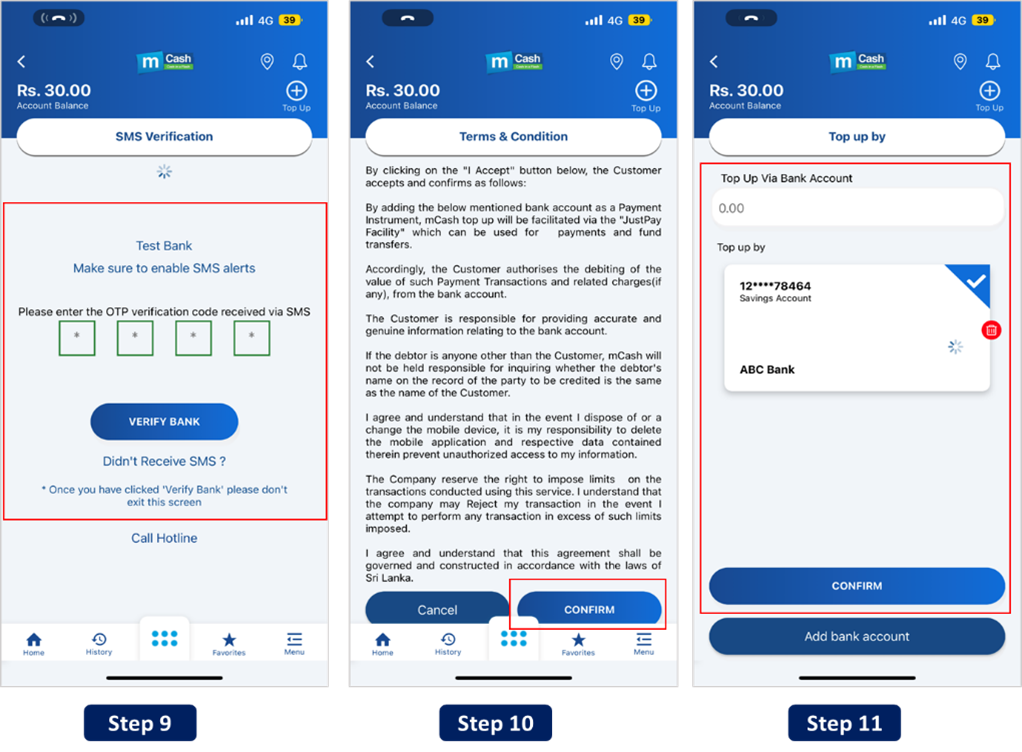

1. Log in to mCash App

2. Select ‘ Topup’ icon in the home screen

3. Select ‘ Bank Account’

4. Enter Bank Account Number & Name

5. Add ‘Email address’

6. Verify OTP received via SMS

7. Consent to the terms & conditions

*Please provide mCash PIN where required.

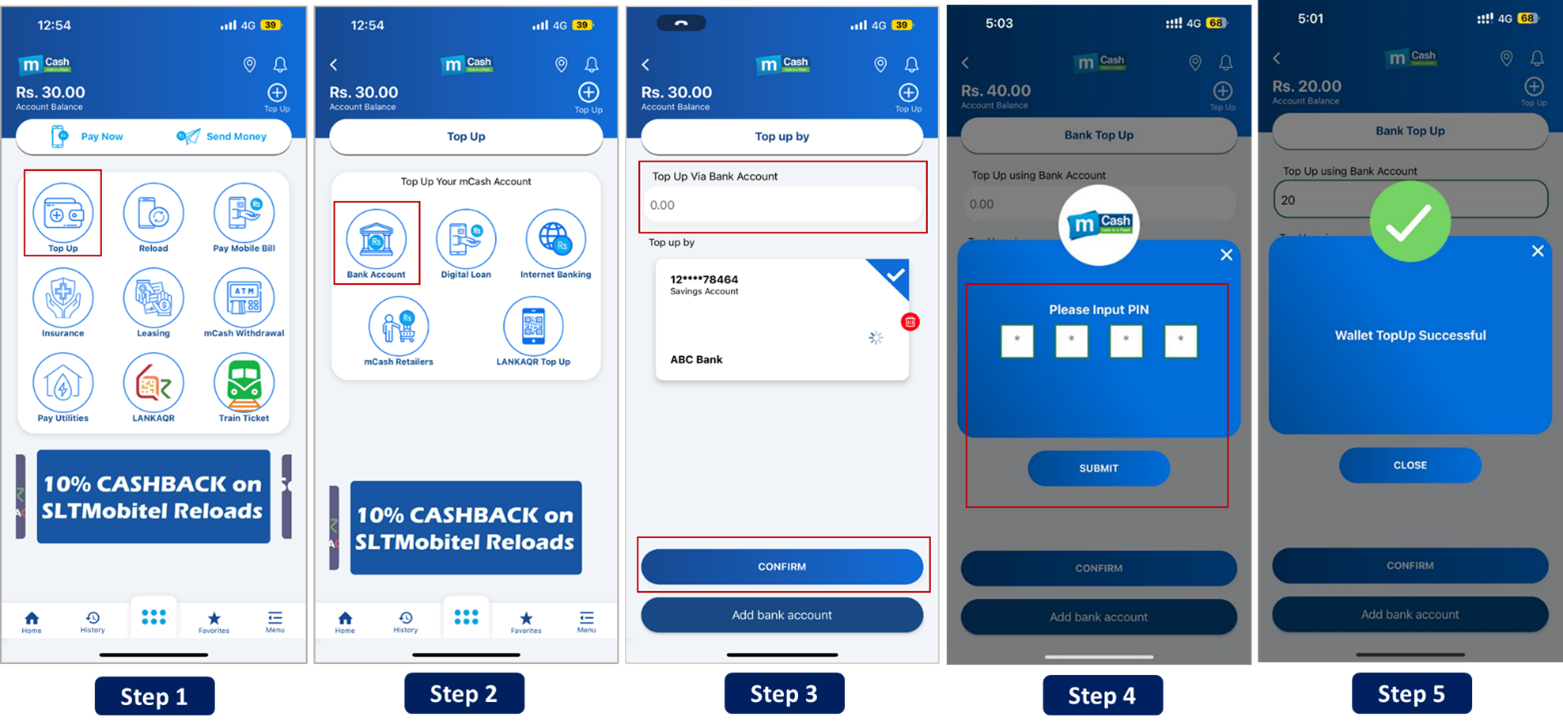

1. Log in to mCash App

2. Select ‘Topup’ icon in the home screen

3. Select ‘Bank Account’

4. Enter Topup Amount

5. Select Prefer Bank (if multiple banks are linked)

6. Enter PIN to complete transaction.

Instantly your mCash account will receive the mCash Top Up

There is no additional fee for this service

You can try only 3 erroneous entering. After that you need to add the bank account again to get the OTP. Some banks Blocks if you failed to enter the OTP in the first three attempts.

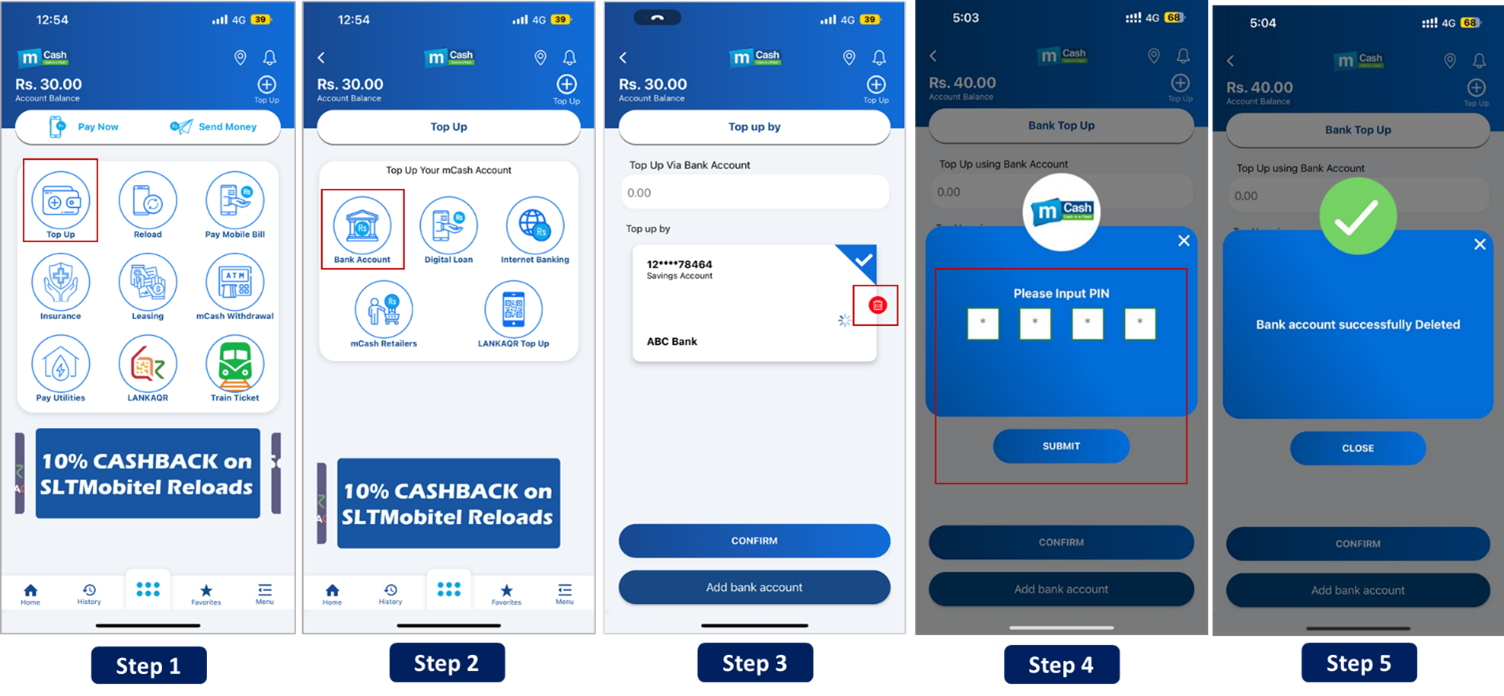

1. Log in to mCash Main Menu

2. Click Top Up Via Bank Account

3. Select the Bank account

4. Select Delete icon in the Saved Bank Account

5. Confirm to successfully remove the Bank account

| Error Message | Reason for the error |

|---|---|

|

Dear Customer, Account details are invalid. Please contact your Bank. |

This could be due to the issues with the Bank account of the customers. ( Eg : Invalid Account Number , Account number not active ) hence the customer should contact his bank |

|

Dear Customer, The Service is unavailable. Please try again later. |

This could be due to Communication issues with the bank hence recommended to Try again later since this is just a temporary issue. |

|

Dear Customer, This Bank account cannot be added. Please contact your Bank. |

This could be due to the entered account is not allowed for this service by the bank hence the customer should contact his bank. |

|

Dear Customer, Transaction Declined. Please contact your Bank. |

This could be due the bank rejected the request due to various reasons hence the customer should contact his bank. |

|

Transaction Failed |

Inform the customer to check the bank balance and to try again later |

FAQ - 10GB Free anytime Data for JustPay Bank Top up

Customers who Top up minimum Rs 100 directly from the Bank Account via the mCash App using the Just Pay will get free data of 10 GB anytime data.

10GB will be provided only for the first transaction after registering for Justpay Bank Topup facility. (Min Transaction value Rs.100)

Customer will get 10GB Data within 12 working days

This is applicable for both Pre paid & Post paid customers.

10 GB data – Valid for 30 days

Yes, All existing & new customers are eligible for this offer.

Yes, this is a limited time offer. SLT-Mobitel reserves the right to change /discontinued at any time.

Customers can now purchase goods at CEYFISH outlets (Sri Lanka Fisheries Corporation) islandwide using LankaQR payment method via any LankaQR certified mobile payment app.

mCash Collaborates with Hatton National Bank to offer Agency Banking Services to their customers via mCash Platform. This service will enable the customers of HNB to make their Deposits, via mCash Channels conveniently.

Any HNB customer can make deposits to HNB.

Customers can make deposits to HNB by visiting any of the SLT-Mobitel branches, Singer Showrooms, Softlogic Retail Outlets & Lanka Bell outlets island wide.

Anyone can make their payments to HNB using the following steps;

> Visit the nearest SLT-Mobitel, Singer, Softlogic or Lanka Bell location

> Inform the staff member that you need to make a deposit to HNB

> Inform Savings/ Current Account (CASA) number

> Inform the amount you wish to deposit

> Inform the NIC number and the contact Mobile number of the depositor

> Inform the Purpose of the Transaction (Ex : Savings, Investments, Business etc.) A confirmation SMS will be sent to the given contact mobile number upon successful payment from both mCash & HNB.

Below are the maximum amounts that could be deposited via mCash per day: HNB Deposits – Rs. 25,000 (Per Account)

All HNB deposits made via mCash are updated real-time.

Deposits of HNB via mCash is free of cost.

After each deposit, made at aforementioned locations, a Confirmation SMS will be sent from mCash, confirming the transaction to the provided Mobile number. Similarly, an SMS will be sent by HNB to the respective account holder’s mobile number maintained at their system.

Customers may contact Hatton National Bank for any enquiries via 011 2 462 462.